The Loan Process and How it Works

Applying for a mortgage can be complicated. Mortgage loans involve great risk on the part of both the lender and the borrower and much due diligence is required to ensure the repayment obligations can be met.

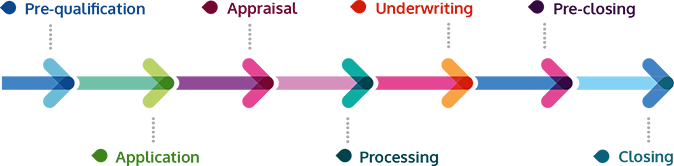

With so many interested parties and moving parts, the mortgage process can easily overwhelm. To help borrowers understand and better navigate the loan process, here is a brief overview and a look at how each stage works:

- Pre-qualification: Before a borrower starts a home search, they should contact us for a pre-qualification. With a pre-qualification, you will know how much home you can afford, which will make shopping a lot easier. This stage usually requires little, if any, documentation.

- Application: The application process is much more in-depth than pre-qualification. During this stage of the process, you will need to provide job and income verification, such as tax returns and paystubs, and an initial credit check will be conducted. Fees and interest rates are discussed during this phase.

- Appraisal: Once the borrower has completed the application, an appraisal is conducted on the subject property. The appraisal is used to determine how much the lender is willing to lend against a certain property and help evaluate risk.

- Processing: Once your loan officer has collected all the necessary documents and your loan file has been opened, your loan moves into processing. The processors reviews all the documents for accuracy, verifies your employment and deposit accounts, and reviews the appraisal.

- Underwriting: Once the processor has verified every aspect of the application and appraisal, the file is sent to underwriting. The underwriter's job is to determine whether or not the loan is an acceptable loan per internal and external guidelines. An underwriter may request additional information from the borrower during this period.

- Pre-closing: After underwriting has approved the loan, the file moves to the closing department. The file is reviewed one more time for errors. In this phase, a title search is conducted, loan contingencies are verified and released and a final closing date is set. Also, documents requiring borrower signatures are signed and notarized.

- Closing: Finally, the loan closes and the seller is paid via cashier's check or bank wire. At this point, title is transferred and keys are exchanged.

While every lender's process varies, this is a general overview of the loan process and how it works. If you still have questions or wish to begin the pre-qualification or application process, call us today.

Building Credit and How FICO Impacts Mortgage Applications

Good credit is key to taking out a loan of any kind, but especially a mortgage. Knowing what's in your credit report and how those individual factors can impact the mortgage process are extremely important. But just because you have poor or below average credit, doesn't mean you can't buy a home.

What is a FICO score?

Credit scores can take on many forms. But the most widely used credit score is FICO. Created by the Fair Issacs Corporation, lender use your personal FICO score to assess risk and determine credit worthiness. While the exact algorithm FICO uses to weigh your credit worthiness is not made public, the following breakdown is generally accepted:

- Payment history (35%): This is a reflection of whether or not bills and other debts are paid on time.

- Accounts owed (30%): This is the amount of money owed on individual accounts in relationship to the credit limit.

- Length of credit history (15%): The amount of time you have maintained credit, such as a credit card.

- New credit (10%): The number of new applications for credit in a given time period, typically two years.

- Credit mix (10%): Different types of credit have different impacts on your credit score. For example, a mortgage, which is guaranteed by the real estate, is given a heavier weighting.

How to improve your credit score

If you find your credit score is below average, there are certain steps you can take to improve it. For example:

- Know what's in your report: You can begin to fix what you don't know is broken. You can get a free copy of your credit report at www.annualcreditreport.com

- Pay your bills on time: The fastest way to improve your FICO score is to pay all your bills by the due date.

- Pay down balances: A general rule of thumb is that credit balances should not be greater than 50 percent of the credit limit.

For more information on how to improve your credit score, call us today. While we do not offer credit repair services, we can help put credit-challenged borrowers on the path to homeownership.