The California Housing Housing Finance Authority has introduced a new Down Payment Assistance Program, better known as the Dream for All purchase loan program.

For new homebuyers, this new loan program alleviates the burden of needing to save up for a down payment altogether.

Essentially the Dream for All program introduces a second mortgage loan of up to 20% of either the property’s purchase price or appraised value (whichever is lower). This second mortgage is paired with the traditional first mortgage and can be used for down payment and closing costs.

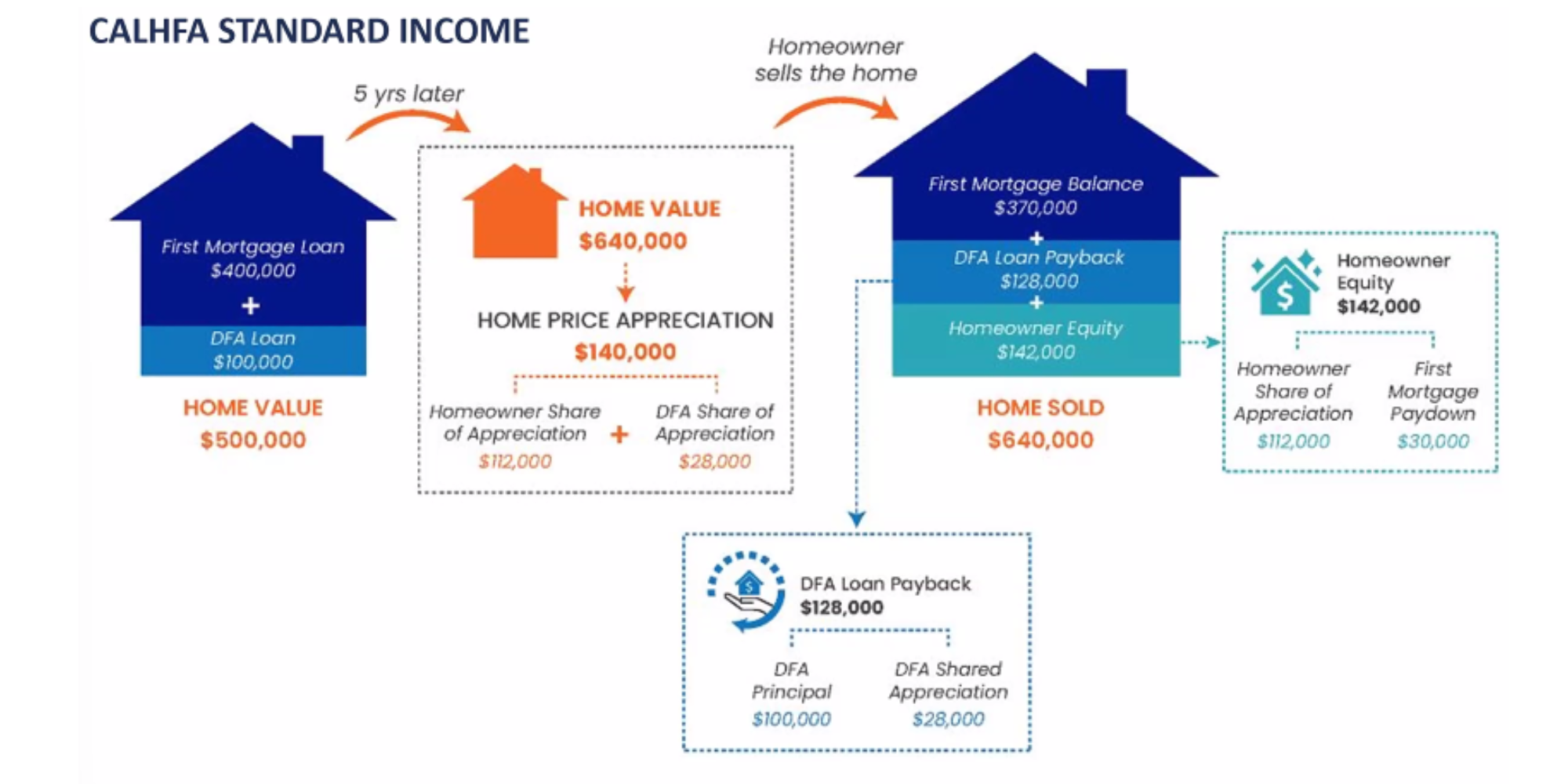

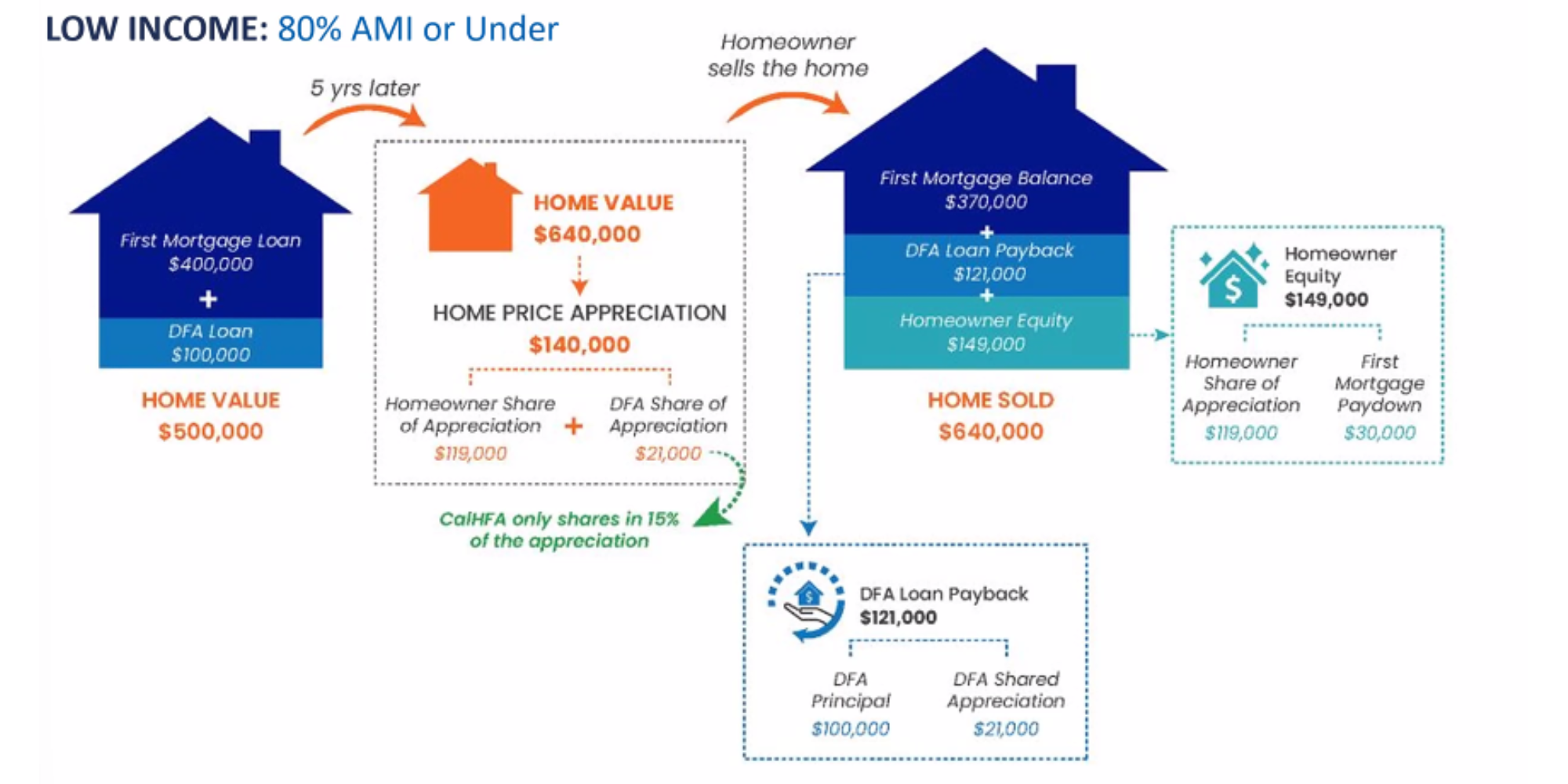

The second mortgage is really the unique aspect of this loan program. This is a shared appreciation mortgage (SAM) and you do not have to make any payments on this loan. Instead, when you sell the property or pay off the second mortgage, you will pay back the original loan balance plus either 15% or 20% of the appreciation on your home.

The repayment percentage is dependent on your income. If you make 80% or less of the Area Median Income you will pay back 15% of the appreciation and if you make more than 80%of the Area Median Income you will pay back 20% of the appreciation. Below is a breakdown of both of these scenarios.

The property you purchase must be a primary residence and only one unit. That includes single-family homes (with an ADU is OK), condos, and townhomes. Manufactured homes are eligible as well. Anything more than one unit is ineligible for this program. Second, the applicant must also have a minimum middle FICO score of 660.

In addition to these requirements, there is a homeowner education course needed to qualify. This is an 8-hour course followed by a one-hour counseling session (there is a $99 fee for this session and the certificate you receive after completion of the course will be good for 12 months).

For more information, please visit our website or call and discuss your options with one of our mortgage professionals at (760) 930-0569.