Have you ever wondered what portion of your mortgage payment goes towards paying down the principal loan balance? The answer is that it changes slightly on every payment you make due to a concept called amortization.

In general, mortgage loans are frontloaded with interest. This means that the earlier payments during the term of the loan have a much larger percentage of the payment going towards interest than paying down the principal. This is also common for most types of financing.

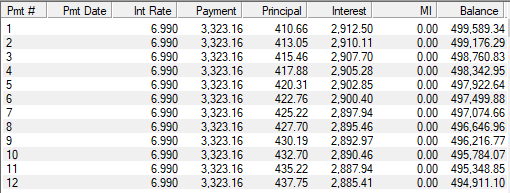

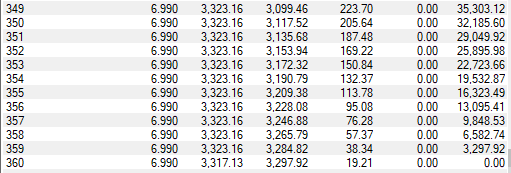

To illustrate, here is a comparison between the first year of a $500,000 for a 30-year fixed mortgage loan term at an interest rate of 6.99% vs. the final year (year 30):

Year 1

Year 30

In the first year after making 12 mortgage payments totaling just under $40,000, only a little over $5,000 in principal reduction is made. In the final year of paying the same $40,000 in mortgage payments, almost $35,000 is applied toward principal reduction.

Amortization is an important concept to understand and Bluefire Mortgage provides every borrower a full amortization schedule for their mortgage prior to the loan closing. If you have any questions, feel free to reach out to discuss with one of our Mortgage Loan Originators at (760) 930-0569.