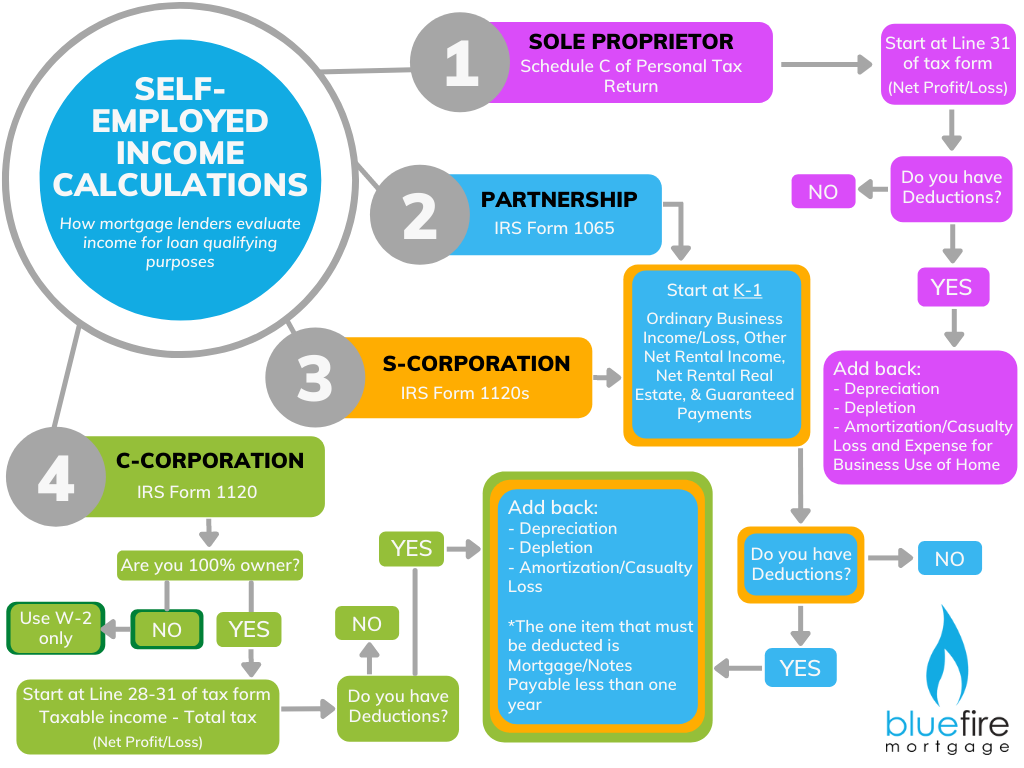

Calculating self-employment income is a little trickier than calculating income for someone who is a full time employee, but there are a few guidelines you can follow to figure out how mortgage lenders calculate your income for mortgage loan qualifying purposes.

Income is going to be calculated based on your Federal Tax Returns. General rule of thumb is that a two year average will be used. Caveats to this are if you have been self-employed for over 5 years or if your income declined year over year. In these two situations, only one year of tax returns will be used.

So now that we know which financial document to look at to calculate income, where do we start? Well, that depends.

For a Sole Proprietor (Schedule C of Personal Tax Return), you will start at Line 31 (Net Profit/Loss).

For a Partnership (Form 1065), start at the K-1 looking specifically at Ordinary Business Income/Loss, Other Net Rental Income, Net Rental Real Estate, & Guaranteed Payments (Part III: Boxes 1,2,3 and 4c).

For a S-Corporation (Form 1120s), start with the K-1 looking specifically at Ordinary Business Income/Loss, Other Net Rental Income, Net Rental Real Estate, & Guaranteed Payments (Part III: Boxes 1,2, and 3).

For a C-Corporation (Form 1120), start with business income for qualifying if you are 100% owner of the business. Assuming you are 100% owner, you will start at Line 28 minus Line 31 (Net Profit/Loss). Line 28 is Taxable income and Line 31 is Total Tax.

I know what you are thinking right now, “Great, I had a bunch of write offs. I’ll have no qualifying income.” Well you are in luck. There are certain items that underwriting is able to add back to your net profit. Downer: There are certain items that have to be deducted as well.

For a Sole Proprietor, you can add back Depreciation (Line 13), Depletion (Line 12), Amortization/Casualty Loss and Expense for Business Use of Home(Line 30).

For a Partnership (Form 1065), you can add back Depreciation (Line 16), Depletion (Line 17), Amortization/Casualty Loss (found on the Statement for “Other Deductions”). The one item that needs to be deducted is Mortgage/Notes Payable less than one year(Schedule L, line 17, column D).

How much you own of the business is going to determine how much of each of the above items you can add back/must deduct. For example, if you own 50% of the business, the add backs/deductions will be limited to 50% of the amount listed on the tax return. If you had $1000 in Depreciation, you would add back $500 for your share of the business.

For a S-Corporation (Form 1120s), it is similar to a Partnership (form 1065). You can add back Depreciation (Line 14), Depletion (Line 15), Amortization/Casualty Loss (Found on Statement for “other Deductions”) and you must deduct Mortgage/Notes Payable less than one year (Schedule L, Line 17, column D). Once again you will take your percentage ownership of the business to determine how much of the add backs/deductions are used for qualifying income.

For a C-Corporation (Form 1120), it is similar to a Partnership and S-Corp with one big difference. Assuming you are 100% owner, you can add back Depreciation (Line 20), Depletion (Line 21), Amortization/Casualty Loss (Found on Statements for “Other Deductions”) and Mortgage/Notes Payable less than one year (Schedule L, Line 17 column D) must be deducted from the business income.

Do note that the Mortgage/Notes payable less than one year can be excluded if the business has assets to cover the note amount, there is evidence the notes payable rolls over regularly, or if the current amount due for the year is part of a larger debt. (Call and ask us about this. We will help you determine if it can be excluded).

If you receive a W-2 from a Partnership, S-Corp or C-Corp, the W-2 will be added to your share of the business income for your total qualifying income.

A line item that used to be deducted from the business income was Meals and Entertainment but starting in 2021, this will no longer be deducted. Reason being, prior to 2021 only 50% of Meals and Entertainment was allowed to be deducted on tax returns so underwriting would deduct this from the qualifying income to account for the other 50%. Starting in 2021, 100% of Meals and Entertainment can be deducted so underwriting will no longer be deducting this from the business income. (Please check with your CPA/tax preparer for details on Meals and Entertainment deduction).

Overview:

Sole Proprietor:

Net Profit/Loss + Depreciation + Depletion + Amortization + Business Use of Home = Qualifying Income

Partnership/S-Corp./C-Corp:

(Net Profit/Loss + Depreciation + Depletion + Amortization – Mortgage/Notes Payable<1year) x Percent of Ownership + W2 = Qualifying Income

If you have any questions in regard to your self-employed income or the forms you need, please reach out to us at (760) 930-0569 and one of our loan officers will assist you.