Personal Bankruptcies

Chapter 7: Liquidation

Liquidation is the most common type of personal bankruptcy. It is the elimination of unsecured debt – including credit card debt, medical bills, and personal loans – legally discharged by a bankruptcy court.

Chapter 13: Reorganization

Reorganization is bankruptcy for those who have fallen behind on their credit payments. The debts are reorganized, and a program is set up to pay them. They have 3-5 years to resolve debts while applying all disposable income to debt reduction. Reorganization also allows for the elimination of unsecured debt, like credit card payments, to catch up on more pressing debt, such as mortgage payments.

Qualifications for Reorganization:

- Have a steady income.

- Have not filed for a Reorganization bankruptcy for two years, or a Liquidation for four years.

- Be current on tax filings.

- Have no unsecured debt of more than $419,275, and current secured debt can’t exceed $1,257,850.

Business Bankruptcies

Chapter 13: Small Business Repayment Plan

Similar to reorganization, small businesses (under 100 employees) can file for a repayment plan which depends on how much the business earns, how much is owed, and the value of the property owned. The reason why this option is sometimes more attractive than Liquidation is it protects personal assets, such as a home, which would be exposed to seizure if a sole proprietor opted for Liquidation.

Chapter 7: Liquidation

For a business that is not seeing any returns and lacks a profitable future, Liquidation is a viable option. The business owner(s) surrender their company completely – nothing is exempt. Once completed, all assets and obligations connected to the business are written off by creditors meaning the former owners are free and clear of all debts and liabilities.

Chapter 11: Business Reorganization

Just like personal reorganization, this gives companies an opportunity to get caught up on payments, and reorganize their financial structure, debts, and assets. If all goes well after 3-5 years of consistency, the business will become more efficient, pay off their debt, and become profitable again.

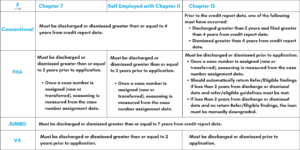

When it comes to applying for a mortgage loan, the type of bankruptcy can have an adverse impact on the ability for the borrower to qualify for financing. The chart below identifies the type of bankruptcy and its effect:

Contrary to popular belief, bankruptcy doesn’t always mean the end for personal or business finances. In fact, sometimes it acts as a fresh start and can be a great catalyst to starting (or restarting) homeownership. If you have any questions regarding the different types of bankruptcy, give us a call at (760) 930-0569 and one of our loan officers will assist you.